The summer before my junior year was one of the most impactful couple of months in my life. I had two internships that summer, one at a PE shop in Chicago and one at a medical device startup in New Hampshire. Chicago was the first time I ever really lived on my own. As a social extrovert, this was hard but, ultimately, really good for me. My summer in Chicago was a step function increase in my personal growth. I don’t think it is a coincidence that I met the woman who would go on to become my wife shortly after returning to school in the fall. I was finally mature enough for that kind of relationship, and my time in Chicago had a lot to do with that.

If Chicago was an accelerant for personal growth, New Hampshire was a catalyst for significant professional development.

I was working at a medical device company while also living with the CEO and his family. It was an intensive business boot camp. During the workweek, I did a rotation throughout the company working on a new project each week. Combined with daily 1v1s with departmental heads, the internship served as a fantastic introduction to the various dimensions of a technology business.

Outside of work, the CEO had me do his P90X workouts with him every day before work at 5 am. This may sound early, but it was a luxury compared to the 4 am wake-up calls I had on the weekends for fishing.

I learned a lot through this experience. I learned the importance of being able to speak just as easily with a dockhand as with a CEO. I learned what a world-class culture feels like and the impact of working at a mission-driven company. I learned that if you want to be truly successful, it is more important to be among the world’s best at something than what that something is.

I think I learned as much out on the boat talking with the CEO as I did in the office. One conversation in particular sticks out. He told me, “at some point, every successful person has to decide whether they want to be a builder or an investor.”

The concept of builder vs. investor has informed much of my career thus far.

After school, I had the opportunity to work at an elite, global investment shop like The Carlyle Group. I got so much from that experience, but I knew pretty early that I wanted to try to find a way back into the startup world as my next step. I knew that I wanted to be part of building companies that make an impact through solving important problems, but I didn’t know the first thing about actually working at a startup.

I thought through my potential options as follows:

I could go try to work at a startup.

I could go try to work at a big tech company.

I could try to get into venture capital.

My only tangible skills were financial management and analysis, so if I did pursue being an operator, it would have to be in some sort of financial analyst role. As positive as large swathes of my Carlyle experience had been, it had also made me realize that I didn’t want to be a cog in the wheel at another big company. Spending the previous two years working on billion-dollar oil & gas transactions also made me want to work with more nascent companies.

So I actually saw my options as follows:

Try to find a startup to join. It would have to be in a financial analyst role, which generally only more mature companies recruit. I would be buying a single lottery ticket, but it would really pay off if the company became super successful.

Try to become a VC. I hoped to leverage my investor’s skill set to land a role at a seed-stage investing shop working with early-stage companies. Instead of a single lottery ticket, I rationalized that I would have visibility on a whole host of different startups. I would develop a broad view of what success looked like, which could inform whatever was next.

I decided to pursue the VC path. My logic was that I could be a real growth partner to startups. I may not be doing the building myself, but I would be an integral part of that process as an investor. I thought I could be a builder through being an investor.

And I was wrong.

Now I don’t regret my choice. It worked out well for me. I thoroughly enjoyed my time as a VC. I learned a lot, built a ton of great relationships, and ultimately ended up here at Wharton, which had been my goal for as long as I could remember.

I didn’t make a wrong choice, but I can see that my logic was fundamentally flawed with hindsight.

The reality is that VCs aren’t builders. They may think they are, and maybe as partners on boards, VCs are adjacent to the building process, but they aren’t builders. Not really. Especially not junior-level VCs.

I had this deep desire to build something meaningful. To be part of creating something new that I could hang my hat on, point to, and say, “I did that.” And as much as I wished it could, I realize now that VC was never going to scratch that itch.

I think a lot of junior and would-be VCs fall into this builder trap. They want to be a company builder, but they don’t have any sort of technical or operational background, so they pursue being a VC. The career provides access to startups has a sheen of sexiness (to its ultimate fault, I would argue).

After a couple of years, all the associates who wanted to be builders end up pretty disillusioned because they aren’t making the impact they had hoped they would.

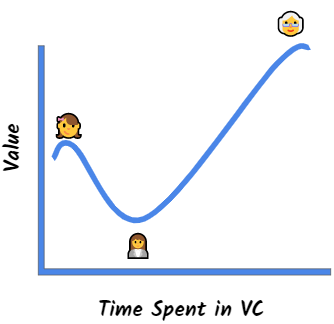

What generally happens next is these aspiring builders leverage the network they have cultivated and their knowledge of startups to land an operating role at a company. Going from VC to operator isn't a bad route at all (at least I hope not because it is the one I am pursuing!). You will leave VC with a robust network in the space, a high-level view of what it takes to build a successful tech company, and the ability to evaluate what strong companies look like.

I don't think this path is as good as jumping straight into an operating role at a future unicorn, but it probably has a lower variance. Worst comes to worst, you can always go and get your MBA and use that as a springboard onto the operating side of the table 😊.

You can't really make a wrong choice when deciding between being an operator and an investor, but I do think you can make a suboptimal one based on your ultimate aspiration.

The number one piece of advice I have for folks interested in pursuing venture capital is to take the time to think about why they want to become a VC. Do they want to be a builder or an investor?

With the benefit of hindsight, my recommendation is only to pursue being a venture capitalist early on in your career if you want to be an investor.

If you want to be a builder long term and pursue VC as a path into that world, you'll get broad exposure, but you'll likely be frustrated with how little impact you make on companies (the extent to which VCs make a tangible impact on companies in general is a debate for another post).

Instead, join a high-growth company. Optimize more for growth and sitting next to brilliant people. Optimize less for the particulars of your role. You can always get into VC down the road. Operating experience will only make you a better, more empathetic, and more credible investor.

If you want to be an investor and want VC to be your asset class of choice, then great! You won’t make as much money as being a PE bro, but the companies you work with are about 1000x cooler, and you may even be able to invest in some companies that change the world.

As with most things in life, there isn't one ideal path. The path you choose matters less than what you do while on it.

But before deciding to jump into the VC rabbit hole, think about what you really want.

Do you want to be a builder or an investor?

The answer will inform a lot.

If you have thoughts on this post leave a comment below or reach out to me on twitter @abergseyeview where my DMs will forever be open.

If you enjoyed this post, you can subscribe here to receive all of my posts delivered directly to your inbox every Monday morning.

If this is the first time you are reading something I wrote and you want to learn more about me, this is a good place to start. It includes some background on me as well as a collection of my top posts.